RITES Limited, a leading Navratna PSU and transport consultancy and engineering giant in India, saw a significant jump in its shares on Monday. The company received an updated contract worth ₹531.77 crore for the “Lumding-Badarpur” railway project, leading to a 12.65% rise in its intraday share price.

Stock Performance

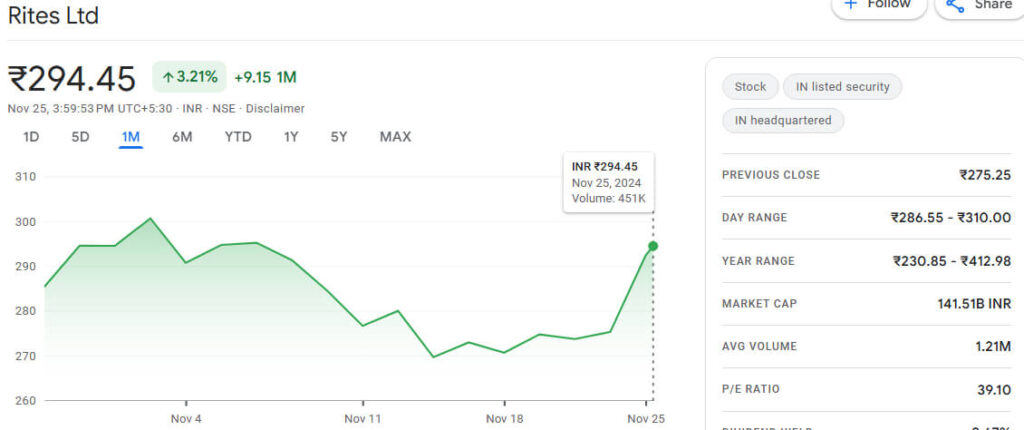

- Market Capitalization: ₹14,216.26 crore

- Intraday High: ₹310 (up by 12.65% from the previous close of ₹275.20)

- Closing Price: ₹292.35 (dipped after profit booking)

- Six-Month Return: 22% for investors

What is the reason of the Rise?

- Updated Contract: RITES received a revised contract for the Lumding-Badarpur railway project.

- Total Revised Value: ₹531.77 crore (excluding GST, including PMC charges), higher than the initial contract value of ₹288.44 crore.

- Project Location: Northeast Frontier Railway’s Lumding Division.

The increased project value is likely to boost the company’s revenue, positively impacting future stock performance.

Strong Order Book and Diverse Portfolio

As of September 2024, RITES Limited’s total order book stands at ₹6,581 crore.

Key Contributions to Order Book:

- Exports: ₹4,240 crore

- Consultancy Services: ₹2,542 crore

- Turnkey Projects: ₹2,506 crore

- Leasing Services: ₹173 crore

- REMC Ltd.: ₹120 crore

The diverse portfolio ensures stable and continuous revenue for the company.

Major Projects Secured in Q2 FY25

RITES Limited secured 91 projects worth ₹729 crore in Q2 FY25.

Important Projects:

- Medical College and Hospital in Amravati: ₹320 crore

- Railway Operations and Maintenance Services for Dhamra Port: ₹100 crore

- TPM and QC Services for 47 roads in Assam: ₹43 crore

- Locomotive Supply Contract to Tsiko Africa Logistics: ₹36 crore

Most of these projects will be completed between 2025 and 2027, ensuring long-term revenue stability.

Also Read: The Downfall of Ola Electric

Financial Performance and Growth Rate

Q2 FY25 Financial Results:

- Revenue: ₹581 crore (7.04% decline compared to the previous year)

- Net Profit: ₹82 crore (25.45% decline)

3-Year Growth Rate (CAGR):

- Revenue Growth: 8.79%

- Net Profit Growth: 3.69%

Important Financial Ratios:

- ROCE (Return on Capital Employed): 25.4%

- ROE (Return on Equity): 17.5%

- Debt-Free Status: The company is almost debt-free.

- EPS (Earnings Per Share): ₹166

Company Overview

RITES Limited (Rail India Technical and Economic Service Limited) was established in 1974. It is a Navratna PSU company of the Indian government. RITES specializes in engineering consultancy, project management, and turnkey solutions in the transport infrastructure sector. The company’s work is not limited to India; it is also active in international markets, including Africa and South Asia.

Also Read:

PM E-Drive Scheme: Great Opportunity in these 3 Electric Three-Wheeler Stocks!

Best Small Cap Stocks with 100% CAGR Over the Last 5 Years

Conclusion

With the ₹531.77 crore railway project order, RITES Limited has strengthened its market position. The company’s robust order book and diverse portfolio prepare it for long-term revenue and profitability. For investors, this stock is an attractive option due to its stability and growth potential.