Jio Financial Services Limited was expected to shake up India’s financial scene, just like Jio did with telecom. But after an initial buzz, the stock price fell sharply. So, what went wrong? In this blog, we’ll look into Understanding Jio Financial Services’ business model, why the stock fell, and what the future holds for the company.

The Rise of Jio Financial Services

Understanding Jio Financial Services started in August 2023, with its stock priced at around 230 rupees. Many investors thought it could be a game changer in the financial sector. The stock shot up to 390 rupees within eight months, giving over 70% returns. However, this high didn’t last long, and the stock went back to its original price of 230 rupees.

Understanding Jio Financial Services Business Model

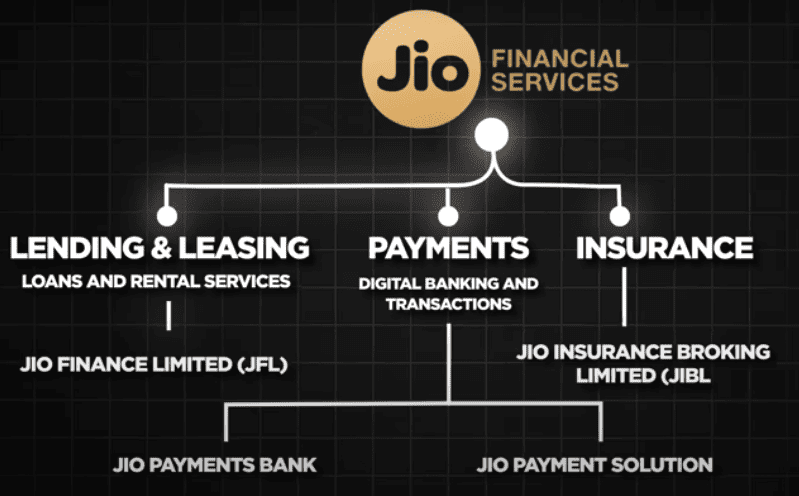

To understand why the stock price changed, we need to know Jio Financial Services’ business model. It is a non-banking financial company (NBFC) offering a variety of financial services like banking, loans, investments, and insurance.

Key Divisions of Jio Financial Services

- Lending and Leasing:

Through Jio Finance Limited (JFL), the company offers loans such as home loans, business loans, MSME loans, and loans against property. JFL had assets under management (AUM) of around 4,199 crores as of Q3 2025.

Apart from lending, Jio Leasing Services Limited (JSSL) focuses on the rental model, allowing businesses and customers to lease IT gadgets, electronic devices, and air fiber devices instead of making an upfront purchase. - Payments:

Jio operates its payments business through Jio Payments Bank and Jio Payment Solutions, providing digital banking and transaction services. Jio Payments Bank mainly caters to customers and individuals, while Jio Payment Solutions serves businesses. They have about 7.4 million users on their Jio platforms. - Insurance Services:

The company also provides insurance through Jio Insurance Broking Limited, offering products like life, health, vehicle, and shop insurance. All these insurance policies are available on the Jio Finance app, making it easy for users to compare and choose the best plans. - Investment Services:

Jio Finance is also expanding into investment and wealth management. Jio BlackRock, a joint venture with BlackRock Inc., aims to offer mutual funds and wealth management services.

In October 2024, SEBI approved Jio BlackRock to launch its operations. Also, Jio has invested around 133,292 crores in the stock market and mutual funds, showing that the company is not just a financial service provider but also an active investor in the market.

As of 2025, the revenue mix shows that interest income is about 38% of the total revenue, dividend income is about 21%, fees and commission are about 8%, and the net gain on fair value changes is about 33%. This revenue distribution indicates that Jio Finance isn’t just dependent on lending income but also earns significantly through investments, dividends, and fee-based services.

- Interest Income: 38%

- Dividend Income: 21%

- Fees and Commission: 8%

- Net Gain on Fair Value Changes: 33%

All these services are accessible via the Jio Finance app, allowing users to manage their finances from one platform.

What Went Wrong with Jio Finance?

Despite its strong start, several factors contributed to Jio Financial Services’ stock decline. Here are the key reasons:

- Decline in Reliance Industries Stock Price:

Jio Financial Services owns a 6.1% stake in Reliance Industries. Changes in Reliance’s stock price directly impact Jio Financial’s market value. Reliance’s stock price fell by about 23% in the past few months, which caused a similar drop in Jio Financial’s value. - Weak Q3 Numbers:

The recent Q3 results disappointed investors. Even though the company’s AUM grew significantly, the interest income didn’t match this growth, raising concerns about profitability. - Lack of Growth in Key Financial Metrics:

When Jio Financial Services went public, its revenue was 414 crores, and net profit was 332 crores. By the December quarter, revenue increased only slightly to 438 crores, while net profit dropped to 295 crores. In comparison, competitors like Bajaj Finance showed significant growth, highlighting Jio Financial stagnant performance. - Market Sentiment and Economic Conditions:

The overall market sentiment is bearish, with many stocks declining. The Nifty index is down about 14-15% from its peak. In such a market, even strong companies can see their stock prices drop, and Jio Financial Services is no exception.

Future Plans for Jio Financial Services

Despite these challenges, Jio Financial Services has big plans to improve its offerings and market position. They are working on integrating AI and ML to streamline operations and offer personalized services. The aim is to create a super app combining all financial services in one place for easier management.

Strategic Partnerships

Jio Financial is partnering with fintech startups to innovate and launch new financial products. This approach could drive growth and help the company gain a larger market share.

Valuation Perspective

Jio Financial Services’ stock has dropped about 40% from its peak price. However, its P/E ratio is around 90, which is high compared to other financial companies. The P/B ratio is currently 1.03, lower than its historical average of 1.5, indicating that the stock might be undervalued relative to its book value.

3 Major Upcoming IPOs in 2025: Reliance Jio IPO and 2 more

Conclusion

Jio Financial Services entered the market with strong backing and a wide range of services. However, it faces stiff competition from established players and fintech startups. The path to profitability and growth is still being paved, and investors should take a wait-and-watch approach. While Jio transformed the telecom sector, it remains to be seen if it can do the same in financial services.

Potential investors should keep an eye on the company’s future developments and market conditions before making any decisions. Jio Financial Services’ journey is just beginning, and its evolution in the financial sector is something to watch closely.