Central Depository Services Limited(CDSL), stock price is falling 45% from its 52 Week High. This makes investors worry that if it’s a good time to buy or if there’s trouble ahead.

CDSL is a key player in the stock market, holding over 70% of demat accounts. Its a Duopoly stock because only 2 Players CDSL and NSDL is in this Sector. Let’s look at what’s behind this price drop and What the future scope and challenges for CDSL.

Understanding CDSL’s Business Model

CDSL helps people hold and trade stocks, bonds, and mutual funds in electronic form. Before, people kept shares in paper form, which could get lost or stolen. Now, shares are kept safely in demat accounts.

CDSL has two main business areas:

- Depository Services: This is where most of CDSL’s money comes from (79%). It includes managing Demat accounts, transferring shares, and providing e-voting services for companies.

- Data Entry and Storage: This part brings in about 20% of the revenue. CDSL keeps records of customer information (KYC) for investors. They charge a fee to mutual funds, brokers, and other financial groups for this service.

How CDSL Makes Money?

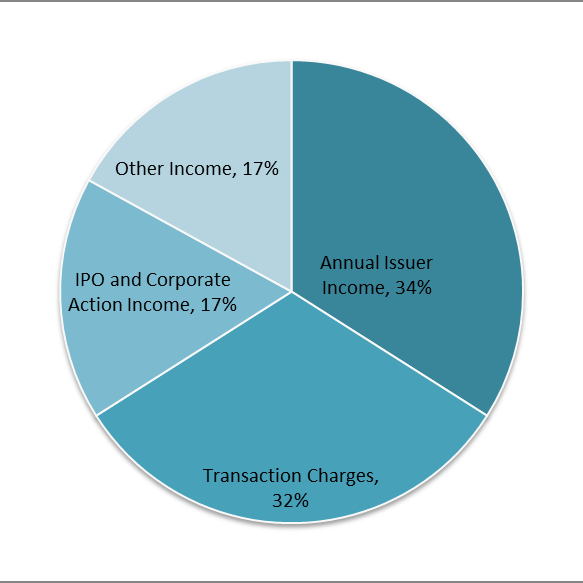

CDSL earns money following 4 ways:

- Annual Issuer Income (34%): Companies listed on the stock market must use CDSL or NSDL. CDSL manages records, helps transfer shares, and handles events like bonus issues and stock splits. In return, CDSL charges these companies a yearly fee. This is a stable source of income.

- Transaction Charges (32%): Every time shares are bought or sold, the transaction goes through CDSL or NSDL. CDSL charges a fee for this service. However, investors don’t pay directly. It’s taken from brokers like Zerodha and Groww, who then pay CDSL. This income depends on market activity.

- IPO and Corporate Action Income (17%): When a company issues new shares or makes changes to existing shares, CDSL handles the process. CDSL charges a fee for this, which adds to their income.

- Other Income (17%): This includes money from services like e-voting, e-lockers, mobile apps, and other tech-based solutions.

Why CDSL Share Price is Falling?

The main problem is with transaction charges. In the third quarter, CDSL’s income from this area dropped from 83 crore to 59 crore.

2 things caused this Price Drop in CDSL:

- Fewer Active Traders: Now Less people are actively trading or investing in the stock market. This is because of a bearish market sentiment, which has scared off investors and traders. New rules from SEBI that limit futures and options trading and higher capital gains taxes have also made investors worry. Many stocks, especially midcap and small cap, have crashed, leading to panic selling.

- Lower Transaction Charges: CDSL decided to lower its charges by 50 paisa per transaction, with an extra discount for female account holders. This was a deliberate move by CDSL, not due to market conditions.

Margins have also dropped. CDSL’s income fell by 14%, and its profit dropped by almost 20%. This is because expenses have gone up, especially for employees and technology.

Technology costs have increased significantly. CDSL says these investments are needed to improve operations and meet future demands.

Also Read: Why Infosys Share is Falling Down?

CDSL Fundamental Analysis

- Market Cap: ₹ 22,384 Cr.

- Stock P/E: 40.3

- Dividend Yield: 0.89%

- High / Low: ₹ 1,990 / 811

- Current Price: ₹ 1,071

- ROCE: 40.2 %

- ROE: 31.3 %

Future Growth and Challenges in CDSL

India has a lot of potential for growth in demat accounts. Currently, only 12% of the population has a demat account. As people become more aware of inflation and the need to invest, more are entering the stock market. Social media and access to information are also helping.

Also there’s limited competition, with only CDSL and NSDL in the market. This gives CDSL a strong advantage in the long run.

In the short term, we need to wait for the next bull market. When the market rises, more retail investors will come in, leading to more transactions and higher income for CDSL. A bull market also encourages new companies to launch IPOs, which brings in more revenue for CDSL.

Also Read: India’s Data Center Boom: Anant Raj and other Stocks to Watch as Capacity Set to Double by 2027

Valuations: Is CDSL Overvalued?

In the last five years, CDSL’s income and profit have grown a lot. However, the stock price has grown even faster. Even after the 44% drop, the stock is still up 10x in five years.

In the past, CDSL’s P/E ratio was over 70, which was a sign of overvaluation. Now, the P/E ratio is around 41, which is closer to its long-term average. This means valuations are becoming more reasonable.

Will the Price Fall Further?

If the overall market recovers, CDSL is likely to bounce back. But if the market keeps falling, CDSL might fall further as well. CDSL’s income is closely tied to market activity.

Ultratech Vs Ambuja: Who is the Market Leader in Cement Sector?

Conclusion

CDSL faces challenges, but it has a strong position in the market. During bull markets, CDSL’s stock price rises sharply. During bear markets, it falls.

Nuclear Energy Stocks in Focus After ₹20,000 Crore Allocation in Union Budget 2025-26