Asian Paints Share Down Reason: Asian Paints has always been a favorite among investors in the Indian stock market. However, its share price has been on a downward trend recently. The company, known for delivering stellar returns over the decades, is now disappointing its investors. Let’s analyze deeper to understand that why Asian paints share is falling?

Performance Over the Last Month and Year

- In the past month, Asian Paints investors have faced an 18% loss.

- Over the past year, the Asian Paints shares have dropped by nearly 20%.

- Looking at the last three years, the share price has been relatively stable around ₹2500, indicating no significant returns for investors during this period.

Also Read : The Downfall of Ola Electric

History As a Great Multi bagger Stock

- In the year 2000, the price of Asian Paints’ shares was just ₹1. Today, it’s around ₹2500.

- The company has delivered a remarkable 226 times return in 20 years. If you had invested ₹1 lakh 20 years ago, it would be worth ₹2.41 crore today.

- However, the performance has stagnated in the past three years.

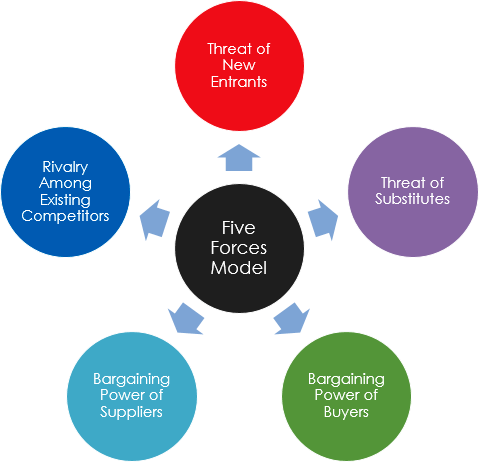

Analysis Using Porter’s Five Forces Model

According to Porter’s Five Forces Model, five key forces affect any industry. The factors impacting Asian Paints are:

- Competitive Rivalry:

- New players like Birla Opus Paints, a brand from Grasim Industries, have entered the market.

- Birla aims to achieve ₹10,000 crore in revenue in the next three years.

- Other competitors like JSW Paints are also emerging rapidly.

- Buyer Power:

- Birla Opus is offering higher discounts and customer-friendly offers.

- Customers can get a 10% discount by scanning a QR code.

- Supplier Power:

- Birla Opus offers dealers 20 days for payment, while Asian Paints gives only 5 days.

- Threat of Substitution:

- The entry of substitute products in the paint industry has increased competition.

- Threat of New Entry:

- The entry of big brands and new players has made the market more challenging.

Increase in Competition

- Asian Paints’ market share is still 60%, but Birla Opus aims to capture 10-12% market share.

- Due to offers like higher margins and longer credit terms, dealers are leaning towards Birla Opus.

Decline in Financial Performance

- In the September quarter, Asian Paints’ profit fell by 40% to ₹694 crore.

- Revenue has also declined compared to the same quarter last year.

- Due to exceptional items, the company suffered a loss of ₹180 crore.

Pressure from Customer Demand and Branding

- Birla Opus is promoting its paints as low-cost, high-quality products.

- Customers are being attracted by discounts and better service.

Pressure on Margins

- When buyer power and supplier power increase in an industry, it negatively impacts companies’ net profit margins.

- Asian Paints is facing this pressure, affecting its share price.

Shifting Preferences of Dealers

- Dealers now prefer brands like Birla Opus due to better credit terms and higher margins.

- This trend is directly impacting Asian Paints’ sales and profit.

Should Investors Be Concerned?

- Although Asian Paints is facing challenges, its brand value and quality remain strong.

- In the long term, the company can maintain its market leadership, but investors need to be cautious in the short term.

Also Read:

4 Large Cap Stocks with Lower PE Ratio than Industry Average: Over 20% Returns!

DMart Struggles: Can the Company Save Itself from Downfall in 2024?

Conclusion

There are several factors behind the decline in Asian Paints’ share price, including increasing competition, the entry of new players, and rising buyer power. The company needs to adjust its strategy to handle these challenges and maintain its leadership.