Small Cap Stocks: The net profit growth of any company is the biggest indicator of its financial strength. If a company has achieved a 100% CAGR (Compound Annual Growth Rate) over the past 5 years, it means that its profits have doubled every year. This performance shows that the company not only has a strong business model but also excels in operational efficiency and cost management.

These kinds of Small Cap Stocks, which show such growth, can create golden opportunities for investors. These companies not only have the capacity to expand within their industry but also promise better returns for investors. Let’s look at four such small-cap stocks that have made their mark in the market with their exceptional performance.

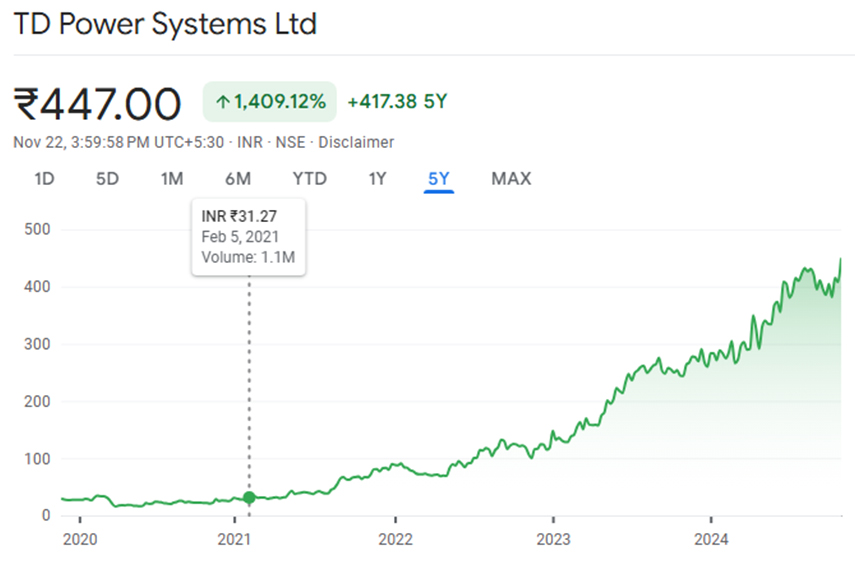

TD Power Systems Limited: Manufacturer of Electric Motors and Generators

TD Power Systems Limited (TDPS) is an Indian company specializing in making AC generators and electric motors. Based in Bengaluru, this company has a strong hold in both domestic and international markets.

Stock Market Data:

- Market Capitalization: ₹6,970 crore

- Share Price: ₹447 (as of Nov 2024)

- P/E Ratio: 51.56

- 5-Year Return: 1,385.48%

Financial Performance:

- Revenue Growth (CAGR): 16.88%

- Net Profit Growth (CAGR): 108.43%

- FY24 Revenue: ₹1,001 crore (14.79% increase)

- FY24 Net Profit: ₹118 crore (21.65% increase)

Other Financial Indicators:

- ROCE: 25.4%

- ROE: 18.1%

- EPS (Earnings Per Share): ₹8.68

- Company Status: Completely Debt-Free

The excellent growth of TD Power Systems Limited makes it highly attractive for investors. Its net profit growth indicates that the company has the potential to further expand its business in the future.

Piccadily Agro Industries Limited: Rising Star in Sugar and Distillery Products

Piccadily Agro Industries Limited (PAIL) specializes in manufacturing sugar and its by-products. Additionally, the company has included distillery products in its portfolio.

Stock Market Data:

- Market Capitalization: ₹6,856 crore

- Share Price: ₹726.70 (as of November 2024)

- P/E Ratio: 54.54

- 5-Year Return: 10,065.52%

Financial Performance:

- Revenue Growth (CAGR): 14.87%

- Net Profit Growth (CAGR): 122.88%

- FY24 Revenue: ₹742 crore (24.08% increase)

- FY24 Net Profit: ₹110 crore (400% increase)

Other Financial Indicators:

- ROCE: 29.6%

- ROE: 30.6%

- Debt-to-Equity Ratio: 0.35x

- EPS: ₹13.3

Piccadily Agro Industries has strongly established its position in the sugar and distillery markets. Its profit growth and strong returns make it a must-watch for investors.

Kirloskar Brothers Limited: Trusted Brand for 135 Years

Kirloskar Brothers Limited (KBL), established in 1888, is a leader in providing fluid management solutions. The company specializes in manufacturing pumps and related systems.

Stock Market Data:

- Market Capitalization: ₹17,319 crore

- Share Price: ₹2,166 (as of November 2024)

- P/E Ratio: 43.56

- 5-Year Return: 1,413.87%

Financial Performance:

- Revenue Growth (CAGR): 3.62%

- Net Profit Growth (CAGR): 159.05%

- FY24 Revenue: ₹4,001 crore (7.27% increase)

- FY24 Net Profit: ₹350 crore (48.31% increase)

Other Financial Indicators:

- ROCE: 27.3%

- ROE: 21.7%

- Debt-to-Equity Ratio: 0.09x

- EPS: ₹49.7

Kirloskar Brothers Limited’s long-standing reliability and impressive growth make it a safe and profitable option for investors.

Also Read: PM E-Drive Scheme: Great Opportunity in these 3 Electric Three-Wheeler Stocks!

Suraj Estate Developers Limited: Trusted Name in Real Estate

Suraj Estate Developers Limited is a Mumbai-based real estate company that primarily develops residential and commercial projects in the South Central Mumbai area.

Stock Market Data:

- Market Capitalization: ₹2,647 crore

- Share Price: ₹596 (as of November 2024)

- P/E Ratio: 24.84

- 5-Year Return: 75.47%

Financial Performance:

- Revenue Growth (CAGR): 63.74%

- Net Profit Growth (CAGR): 101.84%

- FY24 Revenue: ₹412 crore (34.64% increase)

- FY24 Net Profit: ₹67 crore (109.38% increase)

Other Financial Indicators:

- ROCE: 28.7%

- ROE: 23%

- Debt-to-Equity Ratio: 0.79x

- EPS: ₹22

Suraj Estate Developers Limited focuses on developing high-quality projects in premium areas. Its profit growth makes it an attractive option for investors in the real estate sector.

Also Read : 4 Large Cap Stocks with Lower PE Ratio than Industry Average: Over 20% Returns!

Also Read : Quant Small Cap Fund Increases Stake in 13 Stocks in October 2024

Conclusion

These Small Cap Stocks showing over 100% net profit CAGR in the last 5 years are impressive not only for their performance but also for their future potential. Companies like TD Power Systems, Piccadily Agro Industries, Kirloskar Brothers, and Suraj Estate Developers have a strong presence in the Indian market and have the capacity to deliver excellent returns to investors.