Coal India Share Price Target: Coal India Limited (CIL), a major PSU under the Indian government, is currently a hot topic among investors. Morgan Stanley has given a positive outlook for Coal India, rating it as “Overweight” due to increasing electricity demand and strong balance sheet.

Current Performance

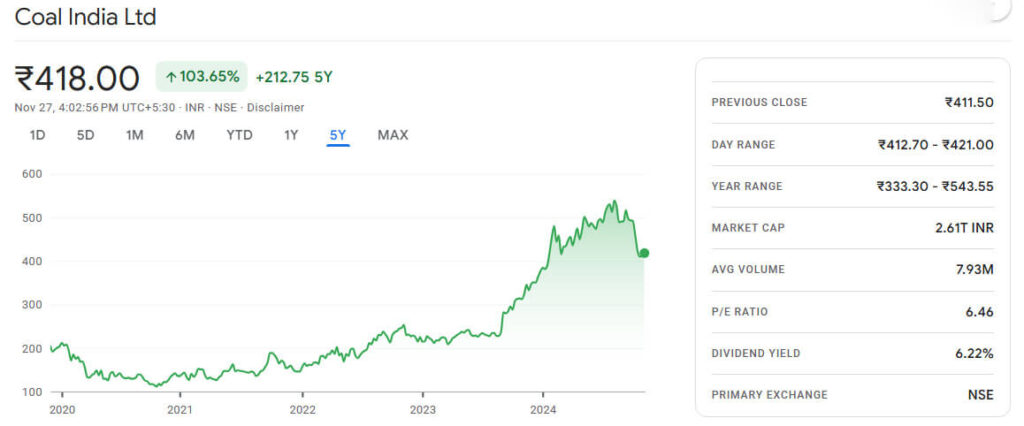

On Wednesday, Coal India shares opened at ₹420, higher than the previous close of ₹411.50. By 11:20 AM, the share price was ₹414.90, showing a 0.83% increase with over 47.47 lakh shares traded1.

As for the Q3 results, Coal India reported a 17% increase in consolidated net profit for the quarter ending December 2023, reaching ₹9,069 crore compared to ₹7,755 crore the previous year. The company’s revenue from operations also saw a 3% increase to ₹36,154 crore.

Coal India Share Price Target for 2025

Morgan Stanley has set a target price of ₹525 for Coal India shares, indicating a potential profit of ₹110 per share for current investors.

Broker Statement

“Morgan Stanley believes Coal India will play a key role in increasing its revenue in the medium term. A strong balance sheet will support investments,” said the broker.

It looks like Coal India has been performing quite well recently. According to the latest reports, Jefferies has set a buy rating for Coal India with a target price of ₹550. Meanwhile, Morgan Stanley has also initiated coverage with an overweight rating and a target price of ₹525, that is a potential upside of around 32%.

#CNBCTV18Market | #MorganStanley initiates #overweight call on #CoalIndia, says strong power demand outlook should support volumes and earnings growth over next few years. Healthy operating cashflows mean limited risks to medium-term dividends/capex pic.twitter.com/x2ae2dVGjH

— CNBC-TV18 (@CNBCTV18Live) November 27, 2024

Coal India Share Price History

Coal India Limited has shown mixed performance over the past few years:

- Last 1 week: 0.91% return

- Last 2 weeks: 2.15% return

- Last 1 month: 9.80% decline

- Last 3 months: 21.70% decline

- Year-to-date (YTD): 8.94% gain

- Last 1 year: 25.02% return

- Last 5 years: 106.99% gain

4 Large Cap Stocks with Lower PE Ratio than Industry Average: Over 20% Returns!

Coal India Dividend History

Coal India is known for providing handsome dividends to its investors:

| Ex Date | Purpose | Amount (₹) |

| 18-Feb-11 | Interim Dividend | 3.50 |

| 08-Sep-11 | Final Dividend | 0.40 |

| 15-Mar-12 | Interim Dividend | 9.50 |

| 06-Sep-12 | Final Dividend | 0.50 |

| 18-Mar-13 | Interim Dividend | 9.70 |

| 06-Sep-13 | Final Dividend | 4.30 |

| 17-Jan-14 | Interim Dividend | 29.00 |

| 03-Mar-15 | Interim Dividend | 20.70 |

| 14-Mar-16 | Interim Dividend | 27.40 |

| 14-Mar-17 | Interim Dividend | 18.75 |

| 27-Mar-17 | Interim Dividend | 1.15 |

| 16-Mar-18 | Interim Dividend | 16.50 |

| 28-Dec-18 | Interim Dividend | 7.25 |

| 22-Mar-19 | Interim Dividend | 5.85 |

| 19-Mar-20 | Interim Dividend | 12.00 |

| 19-Nov-20 | Interim Dividend | 7.50 |

| 15-Mar-21 | Interim Dividend | 5.00 |

| 02-Sep-21 | Final Dividend | 3.50 |

| 06-Dec-21 | Interim Dividend | 9.00 |

| 21-Feb-22 | Interim Dividend | 5.00 |

| 11-Aug-22 | Final Dividend | 3.00 |

| 15-Nov-22 | Interim Dividend | 15.00 |

| 08-Feb-23 | Interim Dividend | 5.25 |

| 18-Aug-23 | Final Dividend | 4.00 |

| 21-Nov-23 | Interim Dividend | 15.25 |

| 20-Feb-24 | Interim Dividend | 5.25 |

| 16-Aug-24 | Final Dividend | 5.00 |

| 05-Nov-24 | Interim Dividend | 15.75 |

At the current market price, Coal India’s dividend yield is 6.26%, making it attractive for long-term investors.

Also Read: PM E-Drive Scheme: Great Opportunity in these 3 Electric Three-Wheeler Stocks!

Why Invest in Coal India?

- Rising electricity demand: Morgan Stanley believes increasing electricity demand will benefit Coal India.

- Dividend yield: A dividend yield of 6.26% provides regular income to investors.

- Share price target: The target price of ₹525 suggests a potential 25% increase from the current level.

- Strong balance sheet: The company’s robust financial base makes it a safe investment for the future.

Conclusion

Coal India Limited is not only benefiting from India’s power sector growth but also attracting investors with its dividends and strong performance. Investing now could be beneficial for those looking for long-term gains.

Also Read:

Asian Paints Share Down Reason

The Downfall of Ola Electric

(Disclaimer: This article is for informational purposes only and should not be considered as investment advice. Smart Money Idea advises its readers to consult their financial advisors before making any financial decisions.)