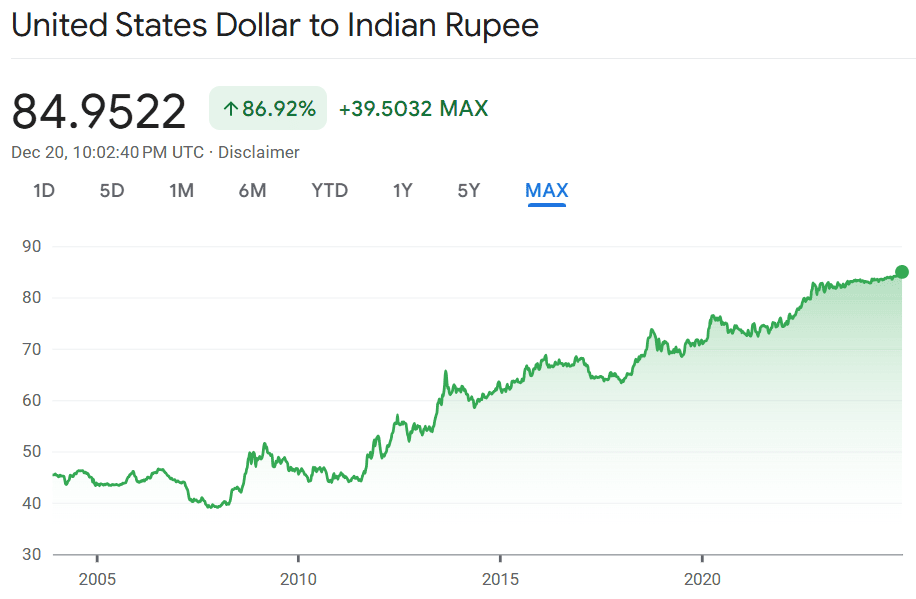

The value of the Indian Rupee is falling for decades. In 1947, 1 Rupee was equal to 1 Dollar, but today it has fallen to around 85 Rupees per Dollar. It might even reach 100 Rupees in the future. Why is this happening? Let’s discuss the 4 main reasons behind the weakening Rupee and explore some solutions.

Reasons of Indian Rupee is Falling

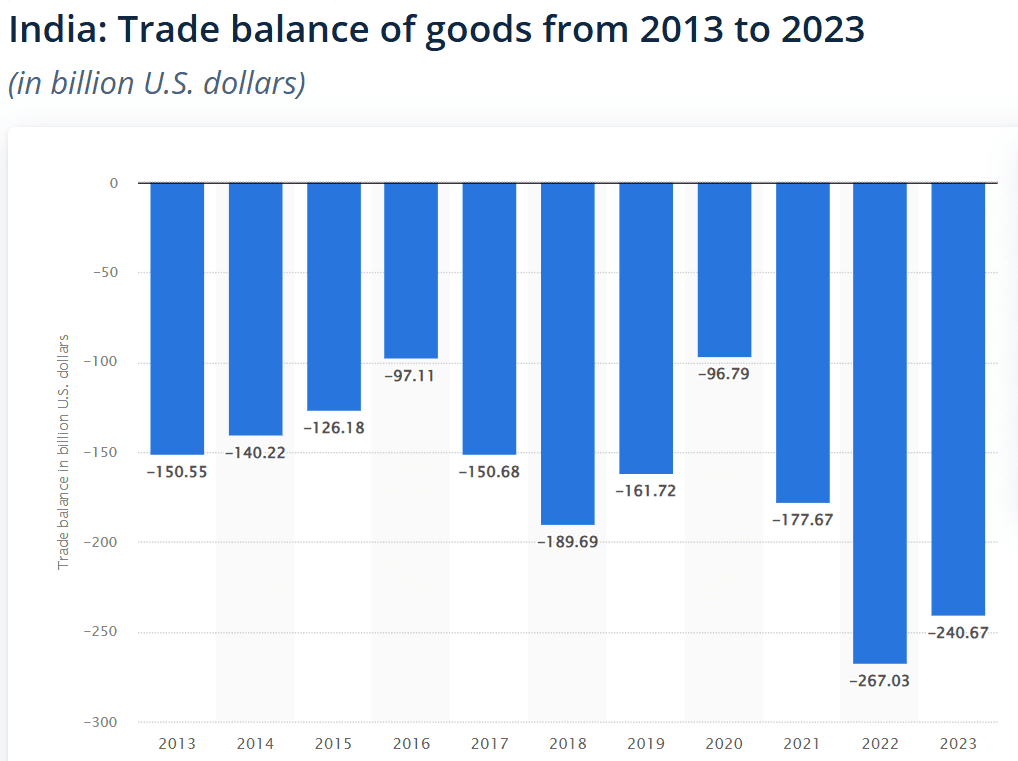

Trade Deficit

India’s Trade Deficit is the biggest reason for the falling Rupee. In November 2024, India’s trade deficit reached 37.85 billion dollars, with imports increasing and exports decreasing.

- Imports: 27% increase compared to November 2023.

- Exports: 4.85% decrease compared to last year.

The impact of this is that India has to spend more Rupees to pay in dollars, making the dollar stronger and the Rupee weaker.

Impact of Dollar Demand and Supply

When a country imports more, it needs more dollars to pay.

Example: If you buy glasses from China, you need to convert Rupees to dollars to pay.

- More imports increase the demand for dollars, causing the Rupee’s value to drop.

- High dollar demand and low supply weaken the Rupee.

Increasing Pressure of Inflation

The fall of the Rupee directly impacts Inflation.

- The Rupee’s fall makes imports expensive, increasing the prices of goods and services.

- If your money is in a bank savings account, you get only 2-3% return, while inflation is 5-6%. This means the value of your money is decreasing every year.

Lack of Exports

India’s exports are not sufficient, resulting in less foreign currency coming into the country.

- If India exported more, dollars would come in, increasing the demand for Rupees.

- Example: China’s Trade Surplus is about 97 billion dollars, while India’s trade deficit keeps growing.

Major Impacts of Weak Rupee

According to Xe Historical Currency Exchange Rates Chart, Rupee was felled 34% in last 10 years.

- Increase in Inflation: Imported goods like petrol, gold, and electronics become expensive.

- Impact on Foreign Investment: A weak Rupee discourages foreign investors.

- Economic Growth: Trade deficit and weak Rupee put pressure on India’s economy.

Also Read: How INR Falling Effect on Your Personal Finance?

Solutions for Strengthening the Rupee

- Promote Exports: India should focus on increasing exports of high-quality products. More exports will bring in dollars and increase the demand for Rupees.

- Control Imports: Control the import of non-essential items.

- Attract FDI and FII: Encourage foreign investors to invest in India.

- Use Stable Money Options: Focus on options like Fixed Deposits (FD) for better returns.

Also Read: How Your Credit Score Affect Your Personal Loan?

Upcoming IPOs in December 2024

Conclusion

The fall of the Indian Rupee is a serious issue for the country’s economic health. To stop this, we need to increase exports, reduce imports, and attract foreign investments. With the right strategies and plans, India can strengthen the Rupee and improve its position in the global economy.