On 10 March 2025, the Nifty IT index dropped by 0.9%, with Infosys among the worst-hit stocks. Infosys’ share price has fell 6.6% in the past five days.

The Indian IT industry has long been the backbone of global technology services. It provides software solutions, consulting, and outsourcing services worldwide. Companies like Infosys, TCS, and Wipro heavily depend on the U.S. market for revenue. When U.S. tech stocks drop, Indian IT firms often feel the pressure too.

Impact on Indian IT Stocks

Recently, the U.S. tech sector faced a sharp downturn. The Nasdaq, a tech-heavy stock index, down 4% on Monday. The seven largest U.S. tech firms lost a massive US$ 750 billion in a single session. Major players like Apple, Nvidia, and Tesla saw sharp declines, triggering panic across global markets.

As a result, Indian IT stocks have also felt the heat.

Factors Affecting Indian IT Stocks

- Weak Dollar: The US dollar has lost strength recently. The Dollar Index, which tracks the dollar against major global currencies, has fallen to 103, down more than 5% from its January peak of 110. A weaker dollar impacts businesses earning in US currency but reporting earnings in other currencies.

Indian IT companies, including Infosys, rely heavily on US revenue. When the dollar weakens, their earnings’ value shrinks when converted to rupees, affecting profitability and investor confidence. - Global Trade Uncertainties: The recent escalation in global trade tensions, particularly due to the US decision to impose higher tariffs on imports, raises concerns about a global economic slowdown. Such measures can disrupt international trade and supply chains, impacting economies worldwide.

Currency volatility from global trade uncertainties can challenge Indian businesses engaged in international trade. - US Recession Fears: Concerns over a possible US recession are growing. The bond market signals this, with yields falling as uncertainty rises. Investors fear higher tariffs and strict trade policies may weaken the US economy, leading to a shift toward safer assets and withdrawals from tech-focused investments. A slowing US economy raises doubts about its ability to sustain businesses relying on American clients. Indian IT firms, including Infosys, earn a large share of their revenue from US companies. If economic conditions worsen, spending on technology services may decline, impacting future earnings and investor sentiment.

#Infosys valuations fall below peers #TCS, #HCLTech post recent share price fall@yoosefkp https://t.co/3bc6Xtbfu2

— CNBC-TV18 (@CNBCTV18Live) March 13, 2025

Also Read: Understanding Jio Financial Services: What Went Wrong?

What’s Next for Infosys?

Infosys is focusing on multiple growth strategies to navigate the evolving market. The company has increased its revenue growth guidance to 4.5-5% in constant currency. Large deal wins remain strong, with total contract value (TCV) for the quarter reaching US$ 2.5 billion, 63% of which is net new business.

The company is prioritizing expansion in financial services, retail, and manufacturing, particularly in North America and Europe.

The financial services sector in the US continues to perform well, while discretionary spending in Europe is improving. Infosys is also leveraging cost optimization initiatives and digital transformation services to drive client engagement and profitability.

Also Read: Top 10 Indian Stocks with Highest Free Cash Flow

Generative AI is a key focus area, with Infosys developing four small language models for banking, IT operations, cybersecurity, and enterprise functions. Over 100 new AI-powered agents are in development for deployment within client ecosystems. Cloud adoption and automation remain integral to the company’s long-term growth strategy, with continued investments in its Infosys Topaz platform.

Infosys Share Price Performance

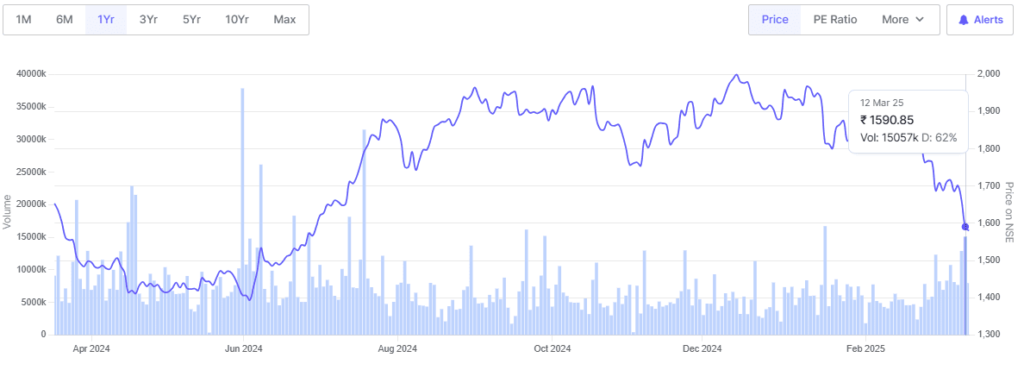

In the past 5 days, Infosys’ share price has tumbled 6.6%.

In the last month, it’s down 14.7%. In 2025 so far, its share price has fallen 15.5%. Also, its share price is down 1.4% in the last year.

The stock touched its 52-week high of Rs 2,006.8 on 13 December 2024 and a 52-week low of Rs 1,359.1 on 4 June 2024.

About Infosys

Infosys is a large Indian IT services company, offering a range of digital and traditional IT services. From humble beginnings in 1981, the company is now among the largest and most respected global software firms. It’s known worldwide for its quality management, work ethics, and corporate governance standards. The company serves industries such as financial services, retail, communication, manufacturing, hi-tech, life sciences, energy, utilities, resources, and services.